Comprehensive Swine Insurance

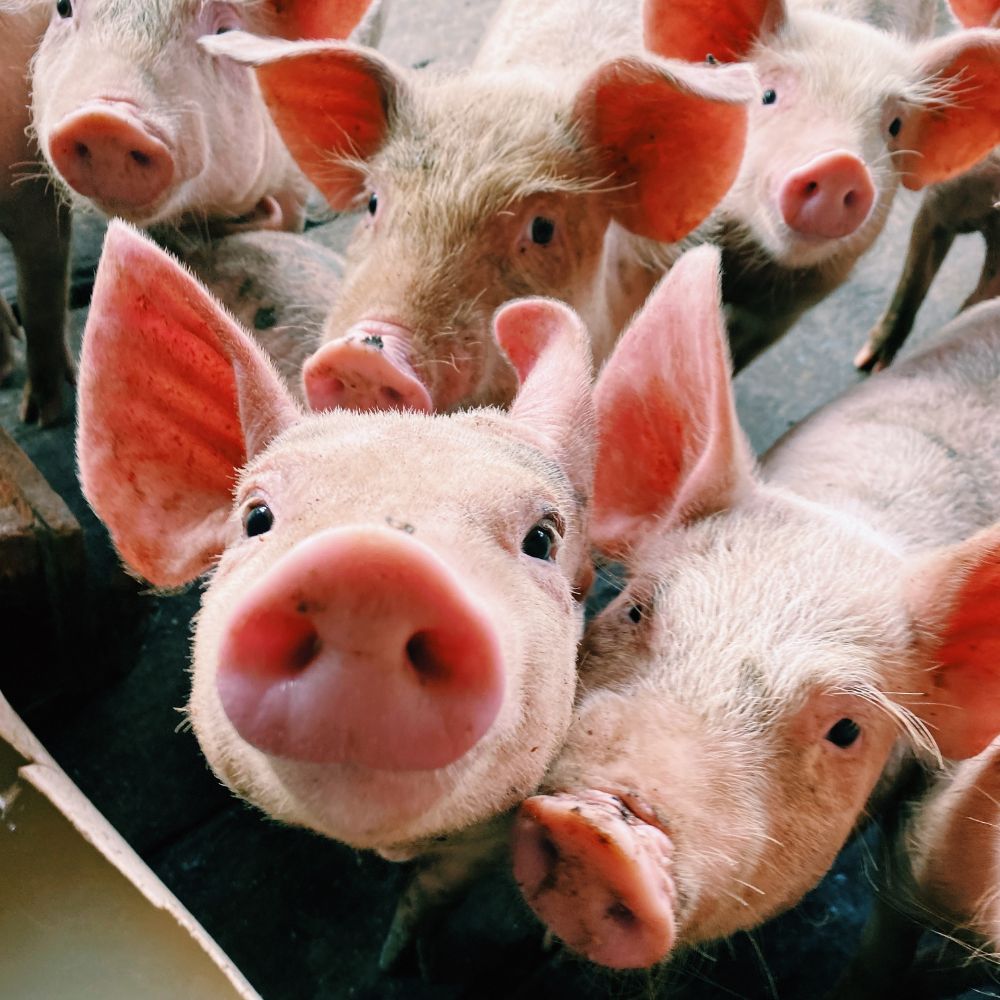

Tailored Coverage for Breed-Specific Needs

Our years of experience in risk management in the swine industry has allowed us to design customized pig insurance plans for specific swine breeds, which includes hormone therapy for weight gain, surgical treatment, and veterinary services to support the individual needs of each breed. We ensure that our clients receive tailored pig insurance coverage that compensates them according to the market value of their livestock and account for their unique breed-specific characteristics. Our team of experts works closely with clients to identify the particular risks associated with their unique breeds and customize pig insurance coverage accordingly.

Our insurance policy includes complete health protection for swine breeds. We tailor our pig insurance plans to include specific riders, vaccinations, and disease prevention measures for particular breeds. Our policies cover the expenses associated with disease management, regular check-ups and preventive measures to improve the overall health and productivity of your swine herd.

Risk Mitigation and Financial Security

That’s where our risk mitigation strategy comes in. Our swine insurance acts as a safety net, providing coverage for losses resulting from a wide range of factors. This includes everything from illnesses such as African swine fever to damages caused by extreme weather events like hurricanes and floods. With our pig insurance policy in place, you can rest easy knowing that your financial interests are well-protected. This gives you the peace of mind to focus on what matters – running your swine operation confidently and efficiently.

We Have Expert Industry Knowledge

We understand the unique challenges and opportunities faced by swine farmers, and we're committed to providing tailored solutions that meet your specific needs. Whether you're a small-scale producer or a large commercial operation, we have the expertise needed to help you navigate the complex world of swine insurance.

Our team is always available to answer your questions, provide advice, and offer guidance on the best pig insurance options for your business. With our help, you can make well-informed decisions about your swine insurance needs and safeguard your financial interests for the long term.

We Provide Tailored Risk Assessments

Frequently Asked Questions

What does swine insurance cover?

Who is eligible for this insurance?

How do I determine the coverage amount I need?

The coverage amount can be determined based on the value of your pig herd and your risk tolerance. Our experts can assist you in assessing your operation’s unique needs and tailoring the coverage accordingly.

What should I do if I need to make a claim?

Can I adjust my coverage if my swine operation changes in size or scope?

How is the premium for swine insurance calculated?

Is there a waiting period before the insurance coverage becomes effective?

How do I get started with swine insurance?